79+ pages when there is a change in estimated depreciation 725kb. Conly future years depreciation should be revised. ABC LTD should account for the change in estimate prospectively by allocating the net carrying amount of the asset over its remaining useful life. For example an entity changing from the reducing balance method to a straight line basis of depreciation should account for this as a change in accounting estimate in line with FRS 102 paragraph 1016 by applying the change prospectively from the date of the change. Read also there and learn more manual guide in when there is a change in estimated depreciation Asked by Djjensen Last updated.

The depreciation expense of previous years is not changed. Any change in the method of depreciation implies a change in accounting estimate.

Depreciation Methods Principlesofaccounting

| Title: Depreciation Methods Principlesofaccounting |

| Format: ePub Book |

| Number of Pages: 302 pages When There Is A Change In Estimated Depreciation |

| Publication Date: July 2020 |

| File Size: 5mb |

| Read Depreciation Methods Principlesofaccounting |

|

Bcurrent and future years depreciation should be revised.

Conly future years depreciation should be revised. Current and future years depreciation should be revised. B current and future years depreciation should be revised. Bcurrent and future years depreciation should be revised. A previous depreciation should be corrected. In some cases the residual value is negligible and thus ignored in depreciation calculation on the basis of immateriality.

Depreciation Impairments And Depletion Ppt Video Online Download

| Title: Depreciation Impairments And Depletion Ppt Video Online Download |

| Format: ePub Book |

| Number of Pages: 152 pages When There Is A Change In Estimated Depreciation |

| Publication Date: September 2020 |

| File Size: 2.3mb |

| Read Depreciation Impairments And Depletion Ppt Video Online Download |

|

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator

| Title: How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator |

| Format: ePub Book |

| Number of Pages: 210 pages When There Is A Change In Estimated Depreciation |

| Publication Date: February 2017 |

| File Size: 800kb |

| Read How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator |

|

Depreciation Of Fixed Assets In Your Accounts Small Business Office Fixed Asset Office Administration

| Title: Depreciation Of Fixed Assets In Your Accounts Small Business Office Fixed Asset Office Administration |

| Format: PDF |

| Number of Pages: 327 pages When There Is A Change In Estimated Depreciation |

| Publication Date: August 2017 |

| File Size: 1.7mb |

| Read Depreciation Of Fixed Assets In Your Accounts Small Business Office Fixed Asset Office Administration |

|

Straight Line Depreciation Accountingcoach

| Title: Straight Line Depreciation Accountingcoach |

| Format: eBook |

| Number of Pages: 279 pages When There Is A Change In Estimated Depreciation |

| Publication Date: March 2021 |

| File Size: 1.7mb |

| Read Straight Line Depreciation Accountingcoach |

|

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business

| Title: The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business |

| Format: ePub Book |

| Number of Pages: 128 pages When There Is A Change In Estimated Depreciation |

| Publication Date: January 2021 |

| File Size: 6mb |

| Read The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business |

|

Straight Line Depreciation Accountingcoach

| Title: Straight Line Depreciation Accountingcoach |

| Format: PDF |

| Number of Pages: 271 pages When There Is A Change In Estimated Depreciation |

| Publication Date: May 2018 |

| File Size: 2.6mb |

| Read Straight Line Depreciation Accountingcoach |

|

Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset

| Title: Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset |

| Format: ePub Book |

| Number of Pages: 165 pages When There Is A Change In Estimated Depreciation |

| Publication Date: October 2020 |

| File Size: 1.6mb |

| Read Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset |

|

Changes In Depreciation Estimate Double Entry Bookkeeg

| Title: Changes In Depreciation Estimate Double Entry Bookkeeg |

| Format: ePub Book |

| Number of Pages: 299 pages When There Is A Change In Estimated Depreciation |

| Publication Date: March 2017 |

| File Size: 1.6mb |

| Read Changes In Depreciation Estimate Double Entry Bookkeeg |

|

Straight Line Depreciation Accountingcoach

| Title: Straight Line Depreciation Accountingcoach |

| Format: eBook |

| Number of Pages: 191 pages When There Is A Change In Estimated Depreciation |

| Publication Date: February 2020 |

| File Size: 3mb |

| Read Straight Line Depreciation Accountingcoach |

|

Depreciation Formula Calculate Depreciation Expense

| Title: Depreciation Formula Calculate Depreciation Expense |

| Format: ePub Book |

| Number of Pages: 135 pages When There Is A Change In Estimated Depreciation |

| Publication Date: June 2017 |

| File Size: 1.7mb |

| Read Depreciation Formula Calculate Depreciation Expense |

|

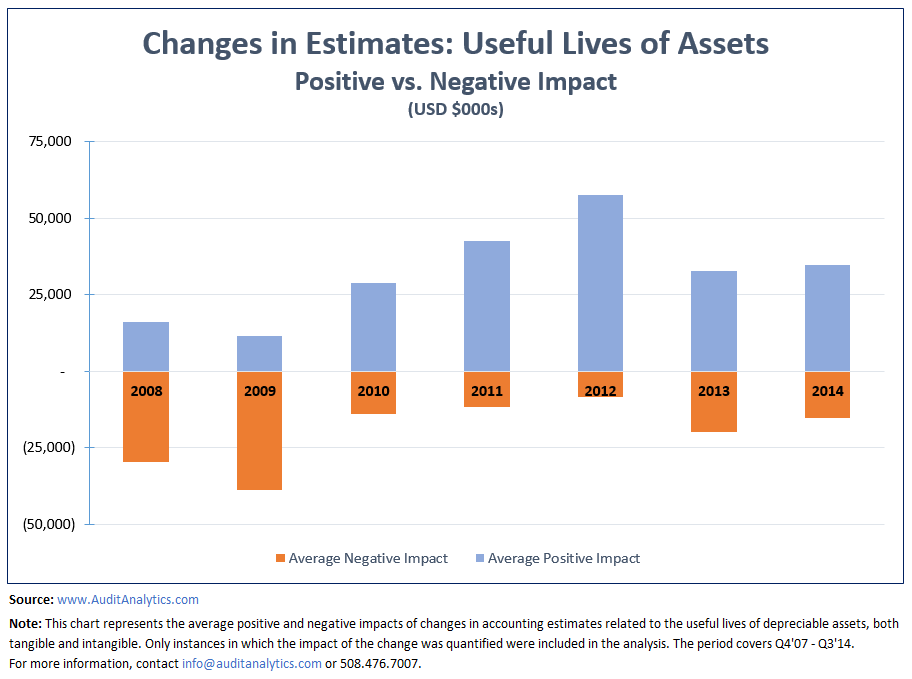

Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics

| Title: Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics |

| Format: PDF |

| Number of Pages: 202 pages When There Is A Change In Estimated Depreciation |

| Publication Date: May 2020 |

| File Size: 2.3mb |

| Read Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics |

|

Bcurrent and future years depreciation should be revised. LO 2 6 When there is a change in estimated depreciation a previous depreciation from ACCOUNTING 5433 at Texas Womans University. B current and future years depreciation should be revised.

Here is all you need to learn about when there is a change in estimated depreciation Usually a change in the estimated useful life of an asset or a change in the estimated salvage value. Bcurrent and future years depreciation should be revised. Only future years depreciation should be revised. Changes in the useful lives of depreciable assets changes in the useful lives of depreciable assets audit analyticsaudit analytics straight line depreciation accountingcoach the small business accounting checklist infographic small business accounting small business finance bookkeeg business depreciation of fixed assets in your accounts small business office fixed asset office administration fixed assets depreciation read full article read full info accounts4tutorials 2015 10 fix accounting and finance asset management fixed asset depreciation methods principlesofaccounting When there is a significant change in the pattern of the future economic benefits from the asset then the method of.

0 Comments